In September this year, the penetration rate of new energy vehicles exceeded 30% for the first time. At the same time that new energy vehicles accelerated their rise, the number of vehicle-to-pile ratio remained at around 1:3, which was still a long way from the target of 1:1.

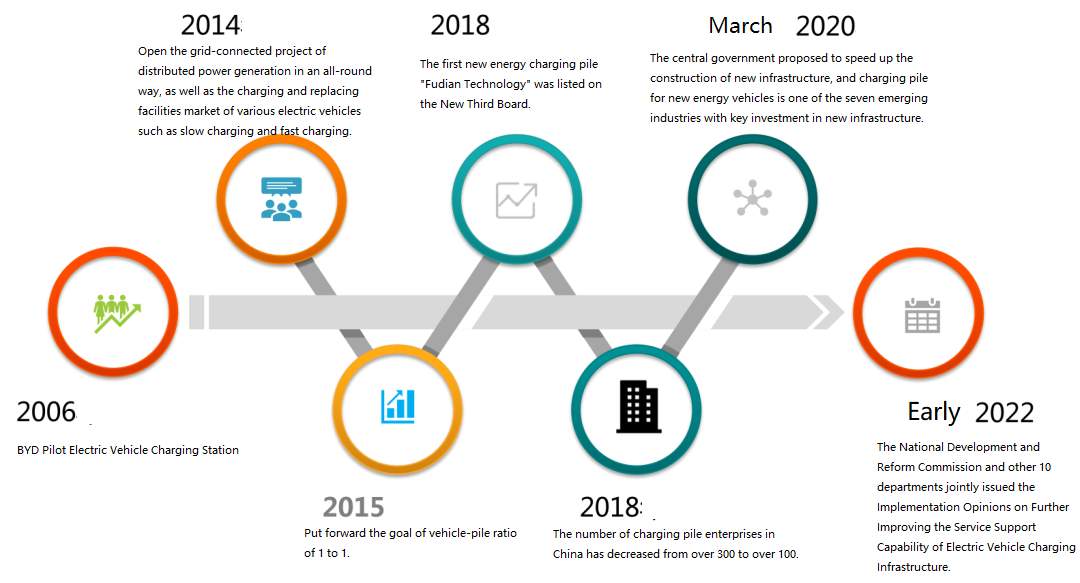

In 2015, the National Development and Reform Commission, the National Energy Administration, the Ministry of Industry and Information Technology and the Ministry of Housing and Urban-Rural Development jointly issued the Guide for the Development of Electric Vehicle Charging Infrastructure (2015-2020) within the system, requiring that by 2020, the ratio of vehicles to piles of new energy vehicles in China should be close to 1:1.

In the past 10 years, although the battery life of new energy vehicles has indeed changed a lot with the development of science and technology, the owners of new energy vehicles still have to face various charging problems from time to time, and the charging pile industry itself still hasn't broken the curse of "low utilization rate, difficult profitability and scattered operation pattern".

According to the 2021 Monitoring Report of Charging Infrastructure in Major Cities of China, in 22 of the 25 large cities in China, the average utilization rate of a single public charging pile is less than 10%.

Peter drucker, the father of modern management, has a famous saying: "The greatest danger in turbulent times is not turbulence itself, but still doing things with the past thinking logic."

The competition for piles in the early stage of the industry led to the brutal delivery and extensive operation, but this kind of play left behind some problems such as "difficult to find piles, many bad piles and slow charging", which gradually eroded the trust of consumers, and in turn restricted the development of related enterprises, eventually forming a vicious circle.

If the growth in the first half depends on capital, can the charging pile industry in the second half find new development ideas when the era of horse racing enclosure has passed?

Two early logic drivers: policy and capital.

2014 is a crucial year for the charging pile industry.

Why do you say that? Before 2014, it was the first wave of construction boom of charging piles, mainly driven by policies, with centralized charging stations built by State Grid and China Southern Power Grid as the main ones. However, since May 2014, it has gradually turned into capital-driven.

At that time, the State Grid Corporation of China held a new market conference on opening the grid-connected project of distributed power generation and electric vehicle charging and replacing facilities in Beijing, and began to open the grid-connected project of distributed power generation and electric vehicle charging and replacing facilities to social capital, while the State Grid turned to focus on building a high-speed and fast charging network.

As a result, a large amount of social capital is eager to move because of the opening of the market gate. The first batch of enterprises that smell the investment opportunities are those related to electric energy and charging technology and equipment, such as Teruide, Fudian Technology, Wanbang Vehicle Industry Group, etc. These enterprises are mainly laid out through free piling, crowdfunding charging piles, shared charging piles, and online sales of electric piles.

On the one hand, enterprises are optimistic about the market prospects, and on the other hand, they are attracted by subsidies for early construction of charging piles. Taking Zhuhai as an example, it is stipulated in the Implementation Rules for the Use of Special Funds for the Promotion and Application of Charging and Replacing Facilities of Provincial New Energy Vehicles in Zhuhai in 2015 that the subsidy standards are: 550 yuan/kW for DC charging piles (machines), 100 yuan/kW for AC charging piles (machines) and 500,000 yuan/station for changing power stations.

The superposition of two factors makes some enterprises accelerate their expansion in a short period of time. According to relevant statistics, in 2017, there were more than 300 domestic charging pile manufacturers and operators.

However, staking a horse means that a lot of money, manpower and material resources need to be used. Yu Dexiang, chairman of TELETTER, once said in an interview with China Entrepreneur Magazine that TELETTER had invested about 500 million in the past few years, and lost more than 800 million in the previous four years. He even admitted that he "almost lost the parent company Teruide".

Changing investment into scale is not a long-term solution.

Since 2018, the charging pile industry has entered the reshuffle period, and companies such as Rongyi Electric and Charging Network Technology have closed down. According to relevant statistics, by the end of 2019, the number of charging pile enterprises in the country has dropped sharply from more than 300 to more than 100.

"Because the construction speed of charging facilities at that time was ahead of the growth speed of electric vehicles, the industry would undergo adjustment and reshuffle, and small-scale companies would gradually be eliminated."

At the same time that some charging pile enterprises have heard the news of bankruptcy, car companies are announcing their entry into the market.

Enter the market drive and call for refined operation.

"When the industry starts from scratch, it must be a resource owner or a well-funded role. However, as the whole industry begins to expand, other factors on which the development of charging services depends are also highlighted, such as real estate, energy storage, etc., thus attracting many new roles to join in." Third-party operation service providers, relying on the charging service resource platform of third-party operation service providers, have more new faces, which is a good thing for the rational development or long-term development of this industry, and is also an inevitable state of industry development.

According to the historical data, the retail penetration rate of domestic new energy vehicles was about 1% in 2015, and it broke through to 5% in the first half of 2019, rising directly to 13.4% in 2021, and then exceeding 30% for the first time in September this year.

It can be seen that the number of new media cars has greatly increased, but on the other hand, as of the end of June 2022, the cumulative number of charging infrastructures in the country was 3.918 million, and the ratio of charging piles to vehicles was about 1: 3.

According to the international general requirements, to completely solve the problem of inconvenient charging of new energy vehicles, the ratio of vehicle to pile should reach 1:1. This means that the "vehicle-pile ratio" of China's new energy vehicles and charging piles has not yet reached the previously planned level.

However, even if it is necessary to vigorously develop charging piles, it is no longer a model of barbaric growth relying on subsidies in the early days, but it begins to become rational. Starting from the real demand of the market, "everyone starts to fight for who has stronger operational capability and whose layout is more reasonable."

After all, from the past experience, the most fatal consequence of unreasonable layout and extensive operation to enterprises is that it is difficult to make money with a long return on investment cycle.

It is understood that the most important mode in the industry at present is the mode dominated by operators, that is, the charging platform connects the charging piles of major operators to its own SaaS platform through its own resource integration capability to earn charging service fees and related advertising fees.

If this profit model wants to grow rapidly, it needs to rely on a high enough utilization rate of charging piles. However, up to now, the power utilization rate of China's public charging pile industry is less than 10%, and to achieve profitability, the utilization rate needs to reach 10%-15%.

Whether it is the development of the industry or the profit demand of the enterprise itself, the market is calling for the emergence of refined operation, and the standardization progress of the industry itself also provides conditions for the rapid entry of these new roles. The technology, operation and platform of the charging pile are mature, which also enables new entrants to run and copy quickly.

The utilization rate is less than 2%, and private piles share or become a trend.

According to the installation location, charging piles can be divided into public piles and private charging piles. Public charging piles are mainly fast charging, and their construction is mainly carried out by major charging service operators. Private charging piles are mainly slow charging, mainly sold or given away by new energy vehicle manufacturers.

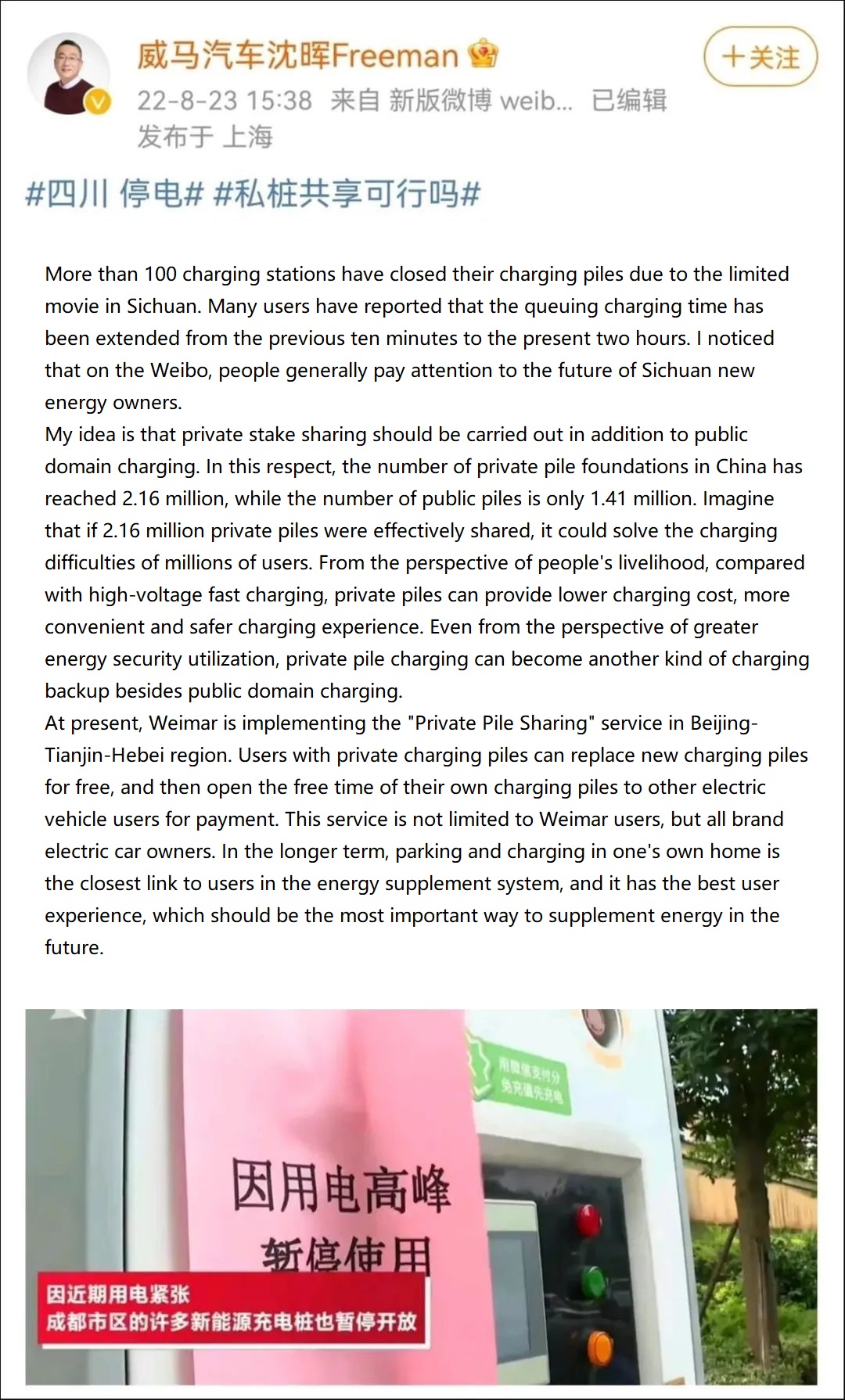

In the process of promoting the development of the whole charging pile industry, people no longer separate the development of the two, and gradually realize the synergy between them.

"At present, the private installation of new energy vehicles accounts for more than 60% of the charging infrastructure, which can be said to be a relatively dominant position." According to Ran Jiangyu, a senior engineer of Urban Traffic Research Branch of China Urban Planning and Design Institute, "At present, the time utilization rate of private charging piles in China is probably less than 2%, while the average time utilization rate of public charging piles around residential businesses in 2021 is 4.7%. In the report released by China Urban Planning and Design Institute this year, it has risen to 9.3%, which means that the time utilization rate of public charging piles is several times that of private charging piles. "

Therefore, he believes that, from the perspective of rational utilization, the mode of loading with vehicles should not continue to penetrate into residential areas. "We prefer to change to the mode of sharing private piles and unified allocation of public piles."

Communicating with a number of new energy owners living in old residential areas, it is also found that it is more and more common to apply for private piles because of the limited community capacitance, difficult expansion and inadequate management. "The community told me because I don't have a fixed parking space and don't install it." A new energy owner said helplessly.

Freeman Shen, CEO of Mawei Automobile, once publicly stated that among the more than 40,000 vehicles delivered in 2021, nearly 20,000 charging piles attached to the vehicles could not be delivered.

Faced with this situation, in January this year, the National Development and Reform Commission, the National Energy Administration and other ten departments jointly issued the Implementation Opinions of the National Development and Reform Commission and other departments on further improving the service guarantee capability of electric vehicle charging infrastructure (hereinafter referred to as the Implementation Opinions). The Implementation Opinions proposed to carry out the "unified construction and unified operation" of charging facilities in residential communities, provide paid services such as construction, operation and maintenance of charging facilities, and improve the safety management level of charging facilities and green electricity consumption. Encourage new modes such as "sharing nearby parking spaces" and "multiple cars and one pile".

As soon as the policy came out, more and more enterprises joined it. For example, recently, State Grid Changzhou Electric Vehicle Service Co., Ltd. launched the "Private Pile Sharing" service on the charging platform. After equipment modification and testing, private charging piles can be put on the platform.

A new energy vehicle owner said that he had shared the charging pile with others, and every kilowatt-hour of 1.5 yuan, after deducting all kinds of expenses, each vehicle could earn about 50 yuan's income.

On August 23rd this year, aiming at the difficulty of charging new energy vehicles caused by the power cut in Sichuan, Freeman Shen, founder of Weimar Automobile, once mentioned the idea of "sharing private piles in addition to charging in the public domain" in Weibo.

However, in the process of promoting the private pile sharing mode, Liu Kai, director of the Technology and Certification Department of China Electric Vehicle Charging Infrastructure Promotion Alliance, also put forward three reminders: First, this mode increases the management difficulty of the property owner, and it is difficult to promote the property owner to actively participate in related work without interest-driven; Secondly, the self-agreement between the pile owner and the user on the charging cost may not conform to the relevant national regulations; Thirdly, in the process of sharing private piles, if there is a safety accident involving personal and property losses, the policy and regulation level needs further study and clarification.

With the triumphant sales of new energy vehicles, the charging pile industry has also ushered in an unprecedented period of development. However, after experiencing the industry cycle of barbaric growth, industry adjustment and resurgence, it is the key to the real improvement of the industry to squeeze out "water" as soon as possible and get rid of the past mode of changing scale by investment.