Recently, Volkswagen Group announced that together with its partners, it has installed more than 15,000 high-power charging piles (HPC) around the world, with an output power of 350kW. And this is only one-third of the target set by the public. According to the plan disclosed by the company, by 2025, there will be 18,000 in Europe, 10,000 in North America and 17,000 in China.

This means that in the next two years, Volkswagen will build 30,000 new charging piles in China, Europe and North America, all of which are 350kW super-charged piles.

China car companies, which are both major manufacturers and far surpass Europe and America in sales of new energy vehicles, are much more conservative in their attitude and actions in building charging service networks. At present, only Weilai and Tucki, the "new forces" who build cars, are accelerating to build their own charging stations, and have formed a certain scale.

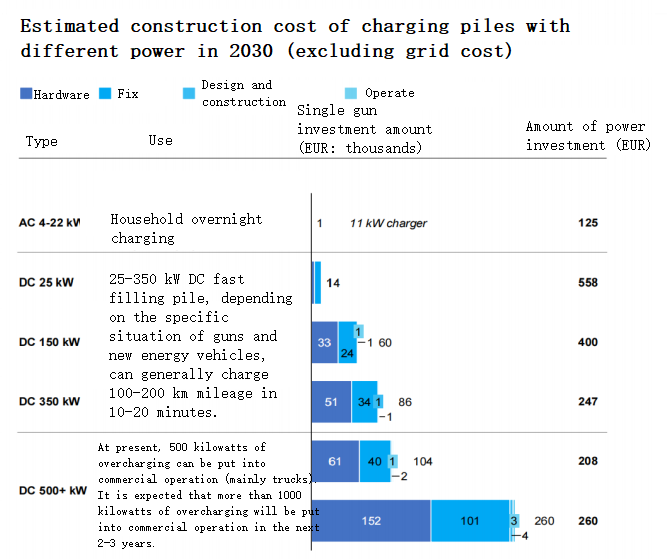

Another difference is that although Europe can't compare with China in the overall quantity and increment of public charging piles, and the proportion of fast charging is not high, there is a detail that Europe is faster than China in the construction of high-power "super-charging piles" above 100kW.

01

"Slow" and "Fast" in Europe

Judging from the figure of vehicle-pile ratio, the number of charging piles in Europe as a whole is insufficient, which really drags down the local new energy vehicles.

The data shows that in 2021, the number of new energy vehicles in Europe was 5.483 million. Due to multiple factors such as the interruption of global epidemic supply chain, chip shortage and the energy crisis caused by the conflict between Russia and Ukraine, the sales volume of new energy vehicles in 2022 was about 2.3 million. According to the statistics of IEA data, the ratio of vehicles to piles has increased from 6.9: 1 to 16.4: 1 in recent five years.

But Europe also has a "fast" side.

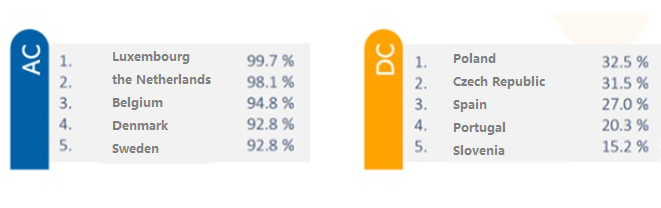

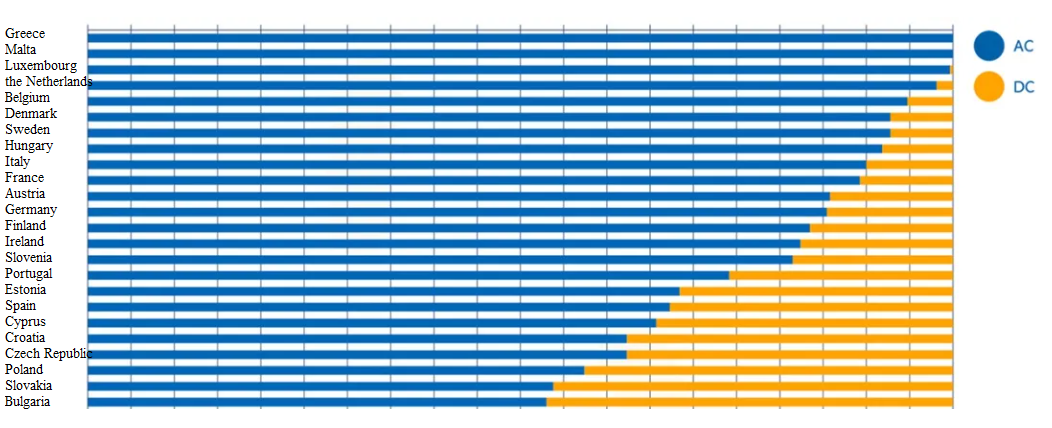

The distribution of public charging piles in Europe is particularly uneven, and the number of charging piles in most countries is small. The three countries with the largest number of public charging piles in Europe are the Netherlands, Germany and France, with 100,092, 78,729 and 65,700 charging piles respectively. However, another set of figures shows that some countries in Central Europe, Eastern Europe or Southern Europe, although the total number of charging piles is relatively small, are the key areas where DC charging piles and super charging piles are concentrated.

For example, in Poland and Czech Republic, the proportion of DC fast-filling piles is 42.6% and 37.7% respectively, and the proportion of fast-filling piles in Spain, Portugal, Slovenia and other countries is also much higher than that in the Netherlands, Germany, France and Britain, where the number of charging piles ranks first.

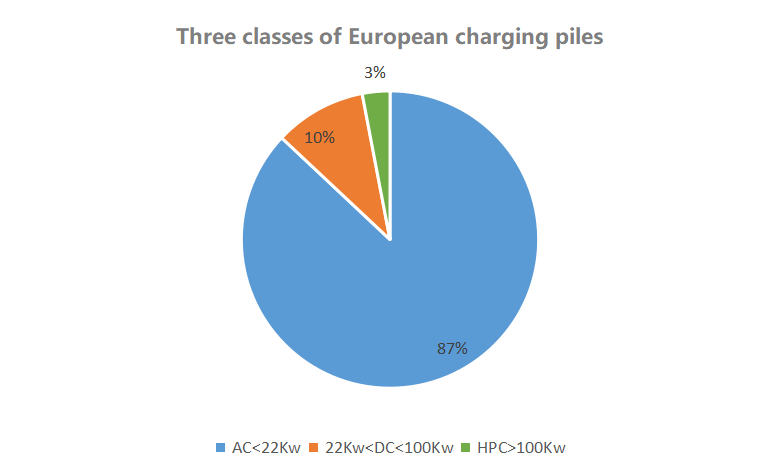

In Europe, charging piles are divided into three classes, one is AC slow pile with power < 22Kw, the other is DC fast charging pile with power < 100Kw, and the third is HPC (Overcharged Pile) with power > 100Kw.

As can be seen from the figure, the proportion of AC charging piles with power less than 22Kw is very high, reaching 87%, while the proportion of DC piles with 22Kw-100Kw is 10%, and the proportion of HPC is 6%. In the HPC area, in recent years, Europe has obviously surpassed China in the construction of high-power super-charged piles, and the super-charged ports of 150Kw, 350Kw or even 480Kw are rapidly laid out. In comparison, the proportion of DC fast-filling piles in China is only 15%, and the DC piles with 20Kw, 60Kw and 90Kw power account for the highest proportion in the stock market, and 120Kw has just entered the mainstream of the incremental market.

Of course, Europe has its own "difficulties" in "rushing to run" on HPC super-filled piles.

Because of the low number of charging piles in Europe, it is more urgent to build a high-power liquid-cooled super-charging network with a capacity of more than 120Kw. Since 2020, the main engine factory has been designing in the direction of 150Kw, directly skipping the general 70Kw limit in China.

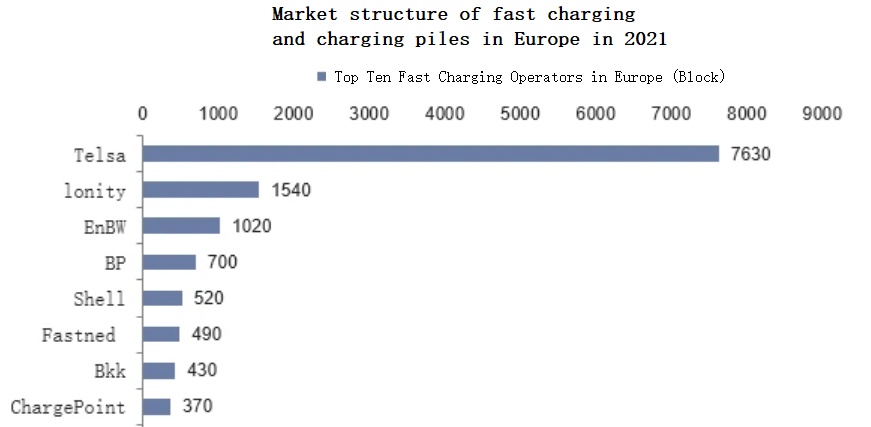

For example, Ionity, the second largest electric vehicle charging service provider in Europe in the field of fast charging, has started to provide overcharging service with a maximum charging power of 350Kw as early as April 2018, and its charging piles are charged through the combined charging system (CCS). The charging power can reach 350kW. In November 2021, BlackRock invested 700 million euros in Ionity, with the goal of expanding its super charging network in Europe and tripling the number of 350kW high-power charging piles to 7,000 by 2025.

Electrify America, which is also positioned as a fast charging network, has also opened the layout of high-power charging piles in the North American market. In 2018, Electrify America built the first ultra-fast charging station with a charging power of 350kW in California, USA. Most charging ports have a power of 150kW, and two CCS plugs have a power of 350kW.

In contrast, domestic high-power charging piles have made slow progress.

To sum up, in addition to the slow pace of product development and design, the biggest bottleneck is that high-power charging piles have a great impact on the domestic power grid, and the distribution network cannot afford the construction of intensive overcharged stations in a short period of time, and it is also difficult to select sites, build stations and increase power capacity.

At present, the charging of new energy vehicles in China is still in the disorderly charging stage, which often coincides with the daily load curve of the power grid, and the charging load is superimposed with the original load, which will form a double peak load. If the peak load of the power grid exceeds the rated capacity of the distribution system, transformers and lines will be overloaded, which will not only lead to potential safety hazards, but also lead to an increase in voltage offset, even exceeding the limited value, and the motor will overheat and reduce the service life of the equipment.

According to the "Analysis on the Impact and Benefit of Electric Vehicle Development on Distribution Network" jointly issued by State Grid Energy Research Institute and NRDC, it is estimated that the peak load in the operating area of State Grid Corporation will increase by 153 million kilowatts by 2030 under the condition of disorderly charging.

Constrained by a series of factors, the landing pace of high-power super-filled piles in China has slowed down a beat.

02

European car companies are more active.

In addition to the keen sense of smell of energy giants, European car companies are more active than domestic car companies in building their own charging stations and service networks.

The most representative brands are Volkswagen, BMW, Audi and other enterprises, especially Volkswagen, which is more radical in the construction of charging service network.

Ionity is an example. This ultra-fast charging operation network company was established in 2017. It was first jointly invested by BMW, Ford, Mercedes-Benz, Volkswagen, Audi and Porsche, and then Hyundai and Kia of South Korea joined in. At present, the company is already the second largest service platform in the European fast charging market.

Moreover, the number of fast-filling piles in the North American market is second only to Tesla's Electrify America, and it is also a subsidiary of Volkswagen. The number of fast-filling piles is close to 3,500, surpassing the third-ranked EVgo, which is 2,100.

Moreover, European car companies have adopted a multi-pronged strategy of integrating Lian Heng, which not only has the linkage with third-party operators, but also accelerates the expansion of their own territory. Mercedes-Benz is like this.

At the Consumer Electronics Show (CES) in 2023, Mercedes-Benz announced plans to establish its own global high-power charging network. Eventually, more than 10,000 charging stations will be built around the world, and each charging pile can provide up to 350kW of power. Moreover, the charging network is different from the Ionity network jointly operated by Mercedes and other automobile brands. Volkswagen even announced in a high-profile way that 45,000 overcharged networks with a power of 350kW will be built around the world in 2025.

The main engine factory has entered the construction of supporting charging stations, and the logic is also very consistent.

The benefits are obvious. Why do Tesla owners prefer to go to their own charging stations to charge? Because it provides a convenient service of instant charging and real-time settlement, and the charging power can be optimized to the best state, the charging time can be minimized.

For example, the owner of a vehicle with Plug&Charge function will automatically identify and authorize charging at the charging station as long as the charging cable is inserted into the vehicle. That is to say, based on the communication mode of PLC, Europe has also begun to fully introduce the way of charging and charging directly from the vehicle, which greatly facilitates the owner.

Although the domestic main engine factory is one step behind, it is also accelerating to catch up and become a key force in the construction of charging piles in the next stage.

At present, many OEMs have started to build their own brand charging stations. Besides Tesla, Weilai and Tucki, Geely's Krypton, BYD, Fox, Mercedes-Benz, BMW, Porsche and Volkswagen have also entered the market.

At the end of last year, Krypton released data, and the self-built charging station broke through 600 stations in 110 cities across the country, with an average of 1.4 stations built every day. It took only 14 months, which shows that it was a big "blood". GAC Ai 'an is also very determined. Last April, it set up the first super charging and replacing center, equipped with A480 super charging piles. It is planned to build 220 charging stations within the jurisdiction of Guangzhou in 2022, and increase to 1,000 in 2025. In the future, it will expand the super charging stations to about 300 cities in China.

Conclusion:

Although the number of charging piles for new energy vehicles in Europe is only one-tenth of that in China, we can see that their leading and rapid layout on super charging piles, as well as the accelerated promotion of energy giants and OEMs, are noteworthy phenomena, and also provide a new perspective for the next domestic charging infrastructure construction.